After 15 years of portfolio managers using a monolithic portfolio structure, it is time to explore a multidimensional approach. The University of Maryland’s Project Management Center of Excellence conducted a 15-month effort for the Office of Secretary of Defense under the DoD Acquisition Innovation Research Center, an University-Affiliated Research Center (UARC), which UMD is a member.

The objective of the research was to expand the use of portfolio-level data, analysis, and visualization of the data across Program Executive Offices (PEOs), Capabilities, and Missions to inform Integrated Acquisitions Portfolio Review (IAPR) and other portfolio decisions. The Department of Defense (DoD) needs more efficient data-driven approaches to improve analytic insights on performance and risk at program and portfolio levels. The research supports Sec. 913 (FY18 National Defense Authorization Act (NDAA)) and Sec. 801 & 836 (FY22 NDAA). Our initial efforts found significant fundamental data reporting gaps.

Since 2008, ongoing attempts by DoD to support decision-making across capability portfolio management have been unsuccessful. UMD team of experts examined the historical and current challenges and proposed a multidimensional portfolio structure schema, which utilizes ANSI Standard for Portfolio Management and is informed by ISO Standard for Building Information Modeling (BIM)s. The initial schema creates a non-hierarchical structure of three portfolio types across component PEOs representing product/platforms, component operational units representing capabilities, and combatant and supporting commander Operations Plans (OpsPlan) representing missions. The multidimensional nature of the structure allows for enhanced management insight and decision-making using structured performance management across the DoD Decision Support Systems (D2S2). Observations and challenges discussed range from the misalignment of work products in the form of Joint Capability Assessment (JCA) with the field use of Universal Joint Task List (UJTL) to not capturing cost estimate’s quantitative risk data. The research team proposed a notional multidimensional programmatics model to demonstrate how key data can be aligned with Mission Engineering and Systems Engineering models, allowing for full utilization of evolving Artificial Intelligence (AI) and Natural Language Processing (NLP) techniques to enhance management insight and decision-making across the enterprise.

This initial results were presented at the Naval Postgraduate School’s Twentieth Annual Acquisition Research Symposium in May 2023.

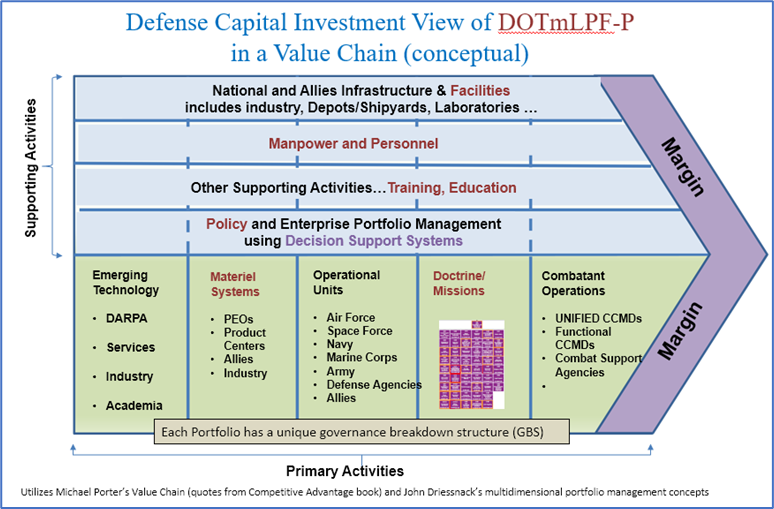

View the Presentation linked to DoD primary functions in its unique value chain.

The UMD Research team proceeded with developing the concepts to consider more of a real-world example, the current US Air Force implementations of Operational Imperative. For years, a portfolio vis program structure has been proposed as the management structure for weapons investments within the Department of Defense (DoD). Program Executive Officers (PEOs) appear to be portfolios, but within the DoD decision support systems (D2S2), programs drive the decision processes, not the PEO structure of portfolios. The concept of portfolio management within the department needs to embrace the seven performance domains within the ANSI Standard for Portfolio Management and move to a more complicated structure. The Section 809 Panel, Volume III, Section 2, Portfolio Management Framework discussed a multilayered approach within a uniform structure. The UMD team found the complexities of the challenges within the military industrial complex required the movement to a multidimensional portfolio management structure under an integrating enterprise portfolio. The approach uses Michael Porter’s Value Chain structure to align portfolio with the department’s primary investment functions, enabling capabilities across combatant command conducting missions with operational units using materiel systems that allow for the incorporation of cutting-edge technology. There may be a need for portfolios that align with the secondary functions within DoD, namely the D2S2, but this should not be the principal portfolio structure.

The Department of Air Force (DAF) Operational Imperative (OI) capital investment initiative, which has already challenged the traditional structure, was seen as a potential pilot for testing the structure. The target result would be a network of aligned decisions model within an integrated master schedule that is informed by the challenges across the portfolios. An enterprise’s information systems within a centralized structure could be constructed, similar to the ADVANA efforts ongoing with DoD, for collecting information and building a model base programmatic (MBProg) tool, which the team name the Integrated Multidimensional Portfolio Analysis Challenge Tool (IMPACT). The goal would be to assist all levels of management with decision analysis with a more holistic integrated view that is focused on management vis oversight needs.

The approach is outlined in the second major paper: DOWNLOAD the 2nd Research Paper

View the overall AIRC Final Report.

The evolution of the multidimensional portfolio management approach has continued with the development of non DoD examples and further research in how a DoD implementation could be accomplished in the near future.

The concept is being presented at the Project Management Institute (PMI) PMXPO 2024: The Future of Your Work on March 21, 2024 by the Principle Investigator John Driessnack.

If you are interested in this research, please contact John Driessnack.

Posted by Kathy Frankle on January 29, 2024

Data Analytics for the Project Manager

Data Analytics for the Project Manager